OneCommute Marketing Automation

We can gather commuter information through:

- Surveys

- Quick Polls

- Event Participation

- Guaranteed Ride Home Applications

- Sustainable Awareness Ranking…..and many more DMP data sources

We can collect information relevant to predicting commuter journeys. Some examples but not limited to:

- Home Address

- Work Address

- Job Classifications

- Preferred Commute Choice

- Commutes Taken Outside of Work Commute

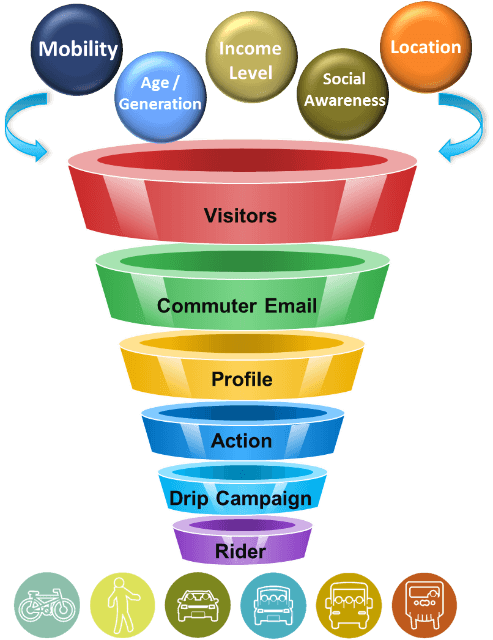

We have created a series of steps designed to walk through a process on our approach to marketing to commuters, riders, and/or passengers. By the way, we use terms like commuters, riders, and passengers inter-changeably because this methodology applies to several types of organizations that provide transportation services to both private and public entities.

STEP 1 – IDENTIFY THE RIDER / PASSENGER / COMMUTER PROFILE TO TARGET

The first step is to identify the profile of the Passenger / Commuter to target. The profile is relevant to the type of subcategories we define. For example: Income may not be relevant for Vanpools, but it becomes highly relevant when considering a transit location. Location to transit is extremely relevant to campaigns for a potential Transit rider, but does not have a high profile score for potential carpool candidates. As we capture information about a Commuter profile it helps us to add to the specific campaigns they should be associated with. We capture relevant profile information over time, which includes accessing Social Media with user credentials to add information to their profile. Capturing commuter behavior on the website allows us to continuously build the commuter profile and adjust the type of campaign they should be associated with.

Step 2 – BUILD COMMUTER / PASSENGER FLOW MODEL

Building a customized scoring and grading model is all about asking the right questions. Use the questions below to guide the conversation with outreach teams and ensure collaboration to effectively establish a lead qualification system.

- What type of Commuter / Passenger to target (i.e. transit riders only or all types of passengers and commuters)?

- Validate the key Commuter / Passenger Profile (CPP) information that meets the targeted criteria (i.e. location, income level, social awareness, etc.)

- Determine the Commuter / Passenger Actions (CPA) that indicate interest

- Create a grading scale that measures the CPP scoring and CPA Actions to determine which Commuters / Passengers to targeting with what message.

Step 3 – Commuter Campaign Nurturing Checklist

Designing nurturing campaigns that effectively move commuters through the cycle is a learning process.

Following the tips below will help ensure campaigns will deliver maximum value and impact.

- Segment. Segmenting commuters focusing on their particular needs, not simply spamming hundreds of recipients on a list.

- Get personal, add personalization.

- Customization can go well beyond using a recipient’s name in the email’s salutation.

- Lend a hand. It’s important that every email sent provides value to your readers.

- Present a value proposition. State the value proposition of each piece of content in order to demonstrate the expertise and the value of the information being provided. Recipients should never wonder why they received an email.

- Link to additional resources. Where applicable, add links to additional content to draw commuters to your site.

- Focus on the commuters. Focus on the commuters’ needs.

Step 4 – MEASUREMENT AND KPI’S

The all-important measurement we have is: are we growing our commuter, passenger or rider base? Are they choosing to use the alternatives and the direction we are trying to point them in? Some Sample Measurements consider for overall success of the program:

- Increase in transit ridership

- Increase in Vanpools

- Increase in Carpools

- Increase traffic to our Ride Matching applications

- Increase in Bike Share activity

- Increase in Corporate Shuttles

- Increase in Uberpool, Lyft or Ride

We can measure the above through various methods including quick surveys, reporting from the area Transit, Ride Match and other organizations that may track activity.

Those measurements are designed to measure the success of the overall program. But what are the soft measurements we should be measuring for success:

- Increase in Number of Potential Commuter Leads

- Increase in Conversions of SOV’s to alternative commutes

- Increase in Property Manager Participation

- Increase in Employer Participation

- Increase in Survey Response

- Increase in Employer Commuter Programs

- Measure movement in the Commuter Funnel

- Increase to Property Value of Commuter Programs

Measuring KPI’s in marketing.

We provide KPI’s that are marketing focused to determine adjustments in campaigns, content, email, etc.

- Increase in Newsletter Sign Ups

- Increase in Web Site Traffic

- Social Media Reach

- Email Marketing Performance

- Delivery Rate

- Unsubscribe Rate

- Open Rate

- Click Through Rate

- Conversion Rate

- Forward/Shares

- Landing Page Conversions

- Blog Post Visits

- SEO Search